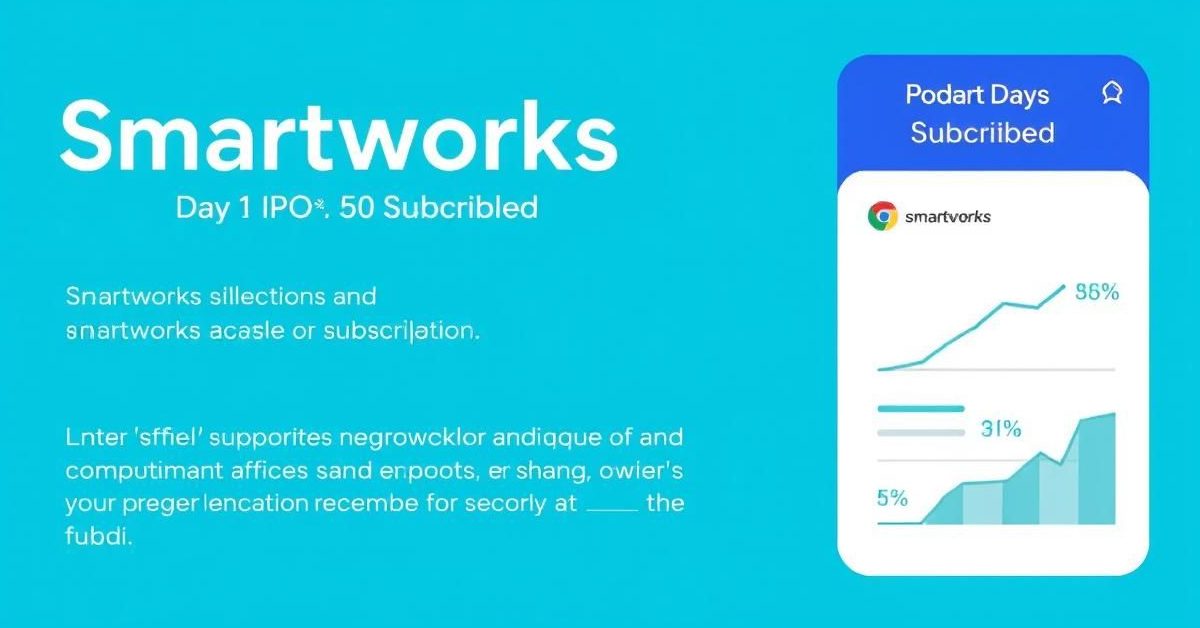

The Initial Public Offering (IPO) of Smartworks Coworking Spaces saw a 50% subscription on its first day, indicating a mixed response from investors.

Smartworks IPO: The First Day’s Performance

Smartworks Coworking Spaces, a prominent flexible office space provider based in Gurugram, launched its IPO on Thursday, July 10. The subscription period is set to run for three days, concluding on Monday, July 14.

On its debut day, the IPO received bids for 52,21,188 shares against a total offer of 1,04,01,828 shares. This translates to a 50% overall subscription rate.

Breaking down the numbers, the portion reserved for non-institutional investors was fully subscribed. However, the quota for Retail Individual Investors (RIIs) garnered a 57% subscription, showing a moderate interest from individual buyers.

Key Dates to Mark Your Calendar

For those interested in the Smartworks IPO, it’s crucial to be aware of the key dates. The subscription window, which opened on July 10, will close on July 14.

The finalization of the share allotment is expected to happen shortly after the bidding period, specifically on July 15. Following the allotment, Smartworks Coworking Spaces Limited shares are tentatively scheduled to be listed on both the NSE and BSE stock exchanges on July 17.

Understanding the IPO’s Financial Details

Smartworks has set its IPO price band between Rs 387 and Rs 407 per equity share. Each share carries a face value of Rs 10, with a tick size of Re 1.

Several financial institutions are involved in bringing this IPO to market. JM Financial Limited, BOB Capital Markets Limited, and IIFL Capital Services Limited are serving as the book running lead managers. Additionally, Kotak Mahindra Bank Limited and HDFC Bank Limited are acting as the sponsor banks for the offering.

MUFG Intime India Private Limited has been appointed as the official registrar for the Smartworks Coworking Spaces IPO, handling all investor records and share transfers.

About Smartworks Coworking Spaces

Smartworks operates on a business model where it leases large office spaces from landlords. These spaces are then transformed into managed flexible office solutions and sub-leased to various corporate clients.

Currently, Smartworks boasts 48 operational co-working centers across India, offering a substantial seating capacity of over 1.9 lakh. Their operational portfolio extends across 8.31 million square feet.

The company also has plans for significant expansion. An additional 0.7 million square feet is currently under fit-outs, meaning it’s being prepared for use. Furthermore, Smartworks has leased another 1.7 million square feet from landlords, which will eventually be developed into new centers. Once fully realized, the company’s total portfolio is set to exceed 10 million square feet.

- Smartworks Coworking Spaces IPO subscribed 50% on Day 1.

- Non-institutional investors fully subscribed, Retail at 57%.

- Price band set between Rs 387 and Rs 407 per share.

- IPO closes July 14, allotment on July 15, listing expected July 17.

- Smartworks manages 48 centers with over 1.9 lakh seating capacity.

Investors will be watching closely to see how the remaining days of the subscription period unfold and the subsequent performance upon listing.