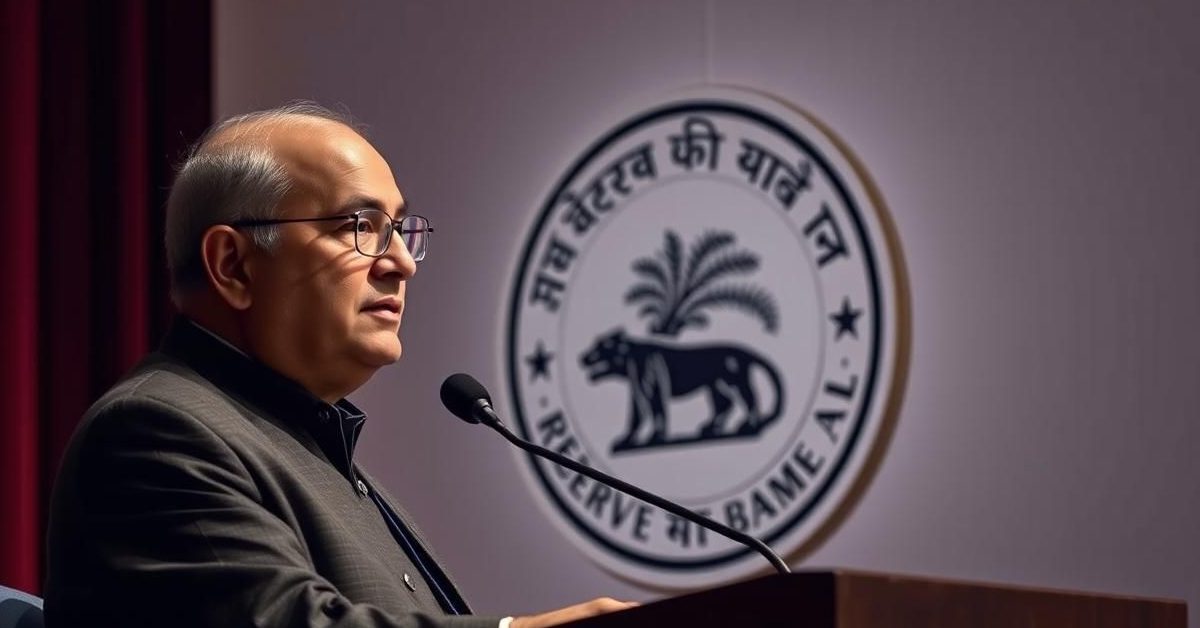

Reserve Bank of India Governor Sanjay Malhotra clarified that future interest rate cuts will hinge on the economic outlook and projections, rather than just current inflation figures.

Future Rate Cuts: It’s All About the Forecast

Speaking at a recent summit, RBI Governor Sanjay Malhotra emphasized that the central bank’s approach to rate cuts will be forward-looking. Decisions will be based on inflation and growth projections, not merely on short-term Consumer Price Index (CPI) data.

Malhotra noted that while inflation may have eased recently, the “war isn’t over.” The Monetary Policy Committee (MPC) consistently looks up to a year ahead when formulating its policy decisions. Despite CPI dropping to 2.1%, it’s expected to rise to 4.4% in the fourth quarter, though a downward revision is possible.

RBI’s Current Stance and Support

The RBI has already implemented a 1 percentage point cut to its repo rate this year, with the full impact now reflected in lending rates. These cuts are aimed at stimulating the economy.

Additionally, the recent reduction in the Cash Reserve Ratio (CRR) to 3% is designed to lower borrowing costs for banks. Malhotra assured that further rate cuts would not trigger asset bubbles, affirming that the RBI retains sufficient tools to support economic growth when needed.

Boosting Credit and Streamlining Rules

Regarding credit flow, the RBI projects credit growth to reach 12.1% in FY25, although it currently stands at 9% for FY26. This indicates an expectation of stronger lending activity in the coming fiscal year.

Beyond monetary policy, the Governor highlighted efforts to simplify India’s financial regulatory landscape. The RBI plans to consolidate over 8,000 existing rules into just 33 comprehensive master frameworks. A dedicated review cell will also re-evaluate policies every five to seven years to keep them relevant and efficient.

Reforming the Banking Sector

Malhotra also touched on banking reforms, expressing concerns about industrial houses owning banks due to potential conflicts of interest. He underscored the RBI’s ongoing financial inclusion drive, with officials actively visiting 2.7 lakh panchayats across the country to facilitate re-KYC (Know Your Customer) processes and broader outreach.

He also defended bank boards amidst recent controversies. While acknowledging the need for vigilance, he stated that boards should not be held solely responsible for all lapses within the banking system.

The Future of Digital Payments

Looking ahead, Malhotra addressed the financing of digital payments. He noted that these transactions are currently subsidized, but suggested that in the future, the costs might need to be shared by users or the government to ensure their sustainability.

- RBI’s rate cut decisions will prioritize long-term economic outlook over short-term inflation data.

- The central bank has reduced the repo rate by 1% this year and lowered CRR to support growth.

- Major regulatory simplification is underway, consolidating thousands of rules into fewer frameworks.

- Concerns persist regarding industrial houses owning banks due to conflict of interest risks.

These insights provide a clear picture of the RBI’s strategic direction, balancing monetary policy with broader financial sector reforms and consumer outreach.