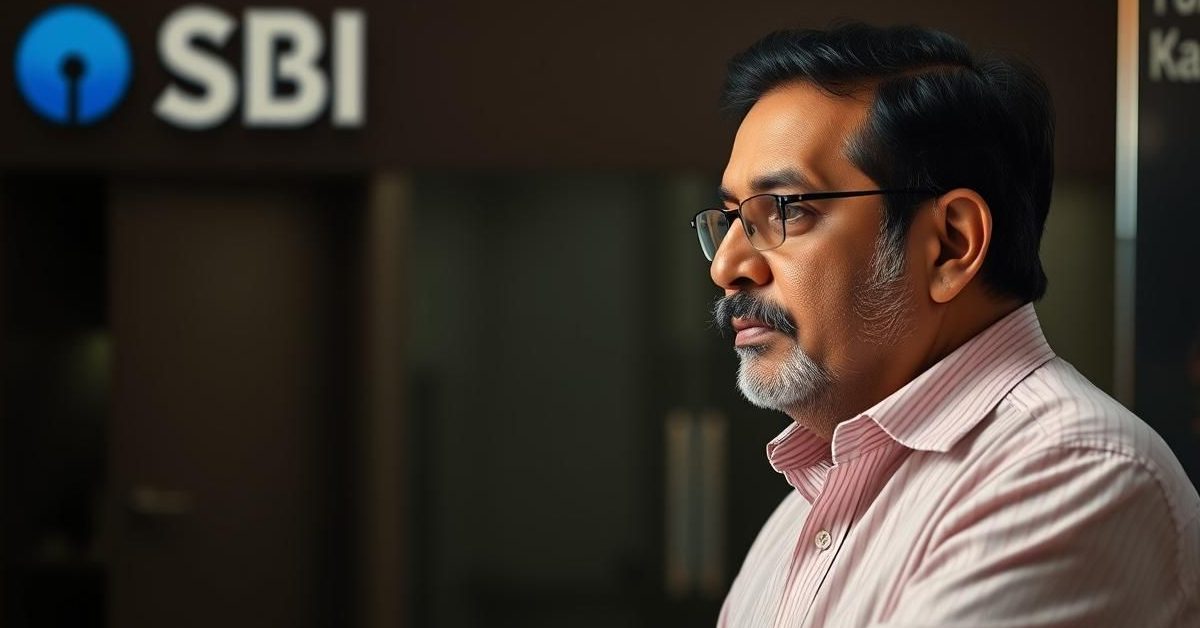

In a significant move that sends ripples through India’s corporate corridors, the State Bank of India (SBI), the nation’s largest lender, has taken a decisive step regarding the beleaguered telecom firm, Reliance Communications (RCom). SBI has officially classified RCom’s extensive loan account as “fraudulent” and, in a parallel action, intends to report the name of its former director, Anil Ambani, to the Reserve Bank of India (RBI).

SBI Flags “Irregularities” in Reliance Communications Account

The decision, revealed through a regulatory filing by Reliance Communications, stems from suspected irregularities identified within the loan account. SBI conveyed its rationale in a letter dated June 23, expressing dissatisfaction with RCom’s explanations following a show-cause notice (SCN).

The bank’s communication highlighted that “sufficient reasons have not been provided” by the company to clarify “non-adherence to the agreed terms and conditions of the loan documents” or to adequately address “the irregularities observed in the conduct of the account of Reliance Communications to the satisfaction of the bank.” This culminated in the Fraud Identification Committee’s firm decision to classify the account as fraudulent.

Anil Ambani’s Name Set for RBI Reporting

The implications extend directly to Anil Ambani, who served as a director of Reliance Communications during the period pertinent to the loan. SBI explicitly stated its intent to “report the account of Reliance Communication and names of Anil Ambani, director of the company, at material time, to the Reserve Bank of India as per the directions contained in the RBI Master Directions/ Circulars issued from time to time, in this regard.” This action underscores the growing scrutiny on the personal accountability of directors in cases of corporate financial distress and alleged misconduct.

RCom’s Ongoing Insolvency Battle and Debt Burden

Reliance Communications, a prominent entity in India’s telecommunications sector until its financial decline, has been undergoing a corporate insolvency resolution process (CIRP) since 2019 under the Insolvency and Bankruptcy Code (IBC), 2016. The company’s colossal outstanding debt, reported to be approximately Rs 40,400 crore, stands as a testament to its severe financial challenges.

A resolution plan, crucial for the company’s future, has already received approval from RCom’s committee of creditors. This plan currently awaits the vital sanction of the National Company Law Tribunal (NCLT) in Mumbai, a step that could determine the fate of the company and its creditors.

IBC’s Shield: RCom Cites Legal Protections

In response to SBI’s classification, Reliance Communications has invoked several provisions of the IBC, emphasizing that the credit facilities in question predate the commencement of its CIRP. The company points to Section 14(1)(a) of the Code, which imposes a moratorium on any suits or proceedings against the company, including the execution of judgments or orders, once the CIRP begins.

Furthermore, RCom highlights Section 32A of the IBC, a powerful provision designed to offer immunity. This section stipulates that upon the NCLT’s approval of a resolution plan, the company is deemed to have immunity from any liability for purported offenses committed prior to the CIRP’s commencement. This includes liabilities potentially arising from “unlawful transactions identified in the forensic audit report.” RCom also cites Section 238, asserting the overriding nature of the IBC’s provisions over other laws.

This legal stance suggests that RCom believes the resolution plan, once approved, should provide a clean slate, shielding it from past liabilities, even those stemming from fraud classifications. The clash between SBI’s assertive classification and RCom’s reliance on IBC’s protective provisions sets the stage for a complex legal and financial battle.